Call volume to the Telluride Fire Protection District has climbed 30 percent since 2017, but the busy agency’s property-tax supported budget has dropped — to $119,000 next year from $250,000 last year.

Chief John Bennett has delayed replacing 30-year-old fire engines. He’s cut and trimmed everywhere he can.

Now, for the first time since 1996, he’s asking voters to allow his district to adjust the tax rate on homes.

“We have not run into a situation where we’ve had to push the panic button. But it’s time to decide about what services we can offer,” said Bennett, the longtime leader of the rural fire district. “We’ve been respectful of the taxpayer, while at the same moment being proactive in taking care of our people and giving them the tools they need to provide emergency services. It’s a real thin line.”

VOTER GUIDE 2018: Resources, explainers, latest news and more

For many rural fire districts across Colorado, recent declines in property tax revenue have forced them to limit the capacity to respond to emergencies. They have crossed that thin line. And, in record numbers, they are asking voters next week for help.

Hefty ballots landed in mountain-town mailboxes last week with community leaders asking for an array of property and sales tax increases to support fire districts, affordable housing, airline programs and community mental health.

On top of an extra-busy state ballot, voters across the Western Slope are deciding whether to allow special districts — specifically, dozens of fire protection districts along with a handful of library, health care and recreation districts — to adjust mill levies as property tax revenue plummets under the state’s Gallagher Amendment.

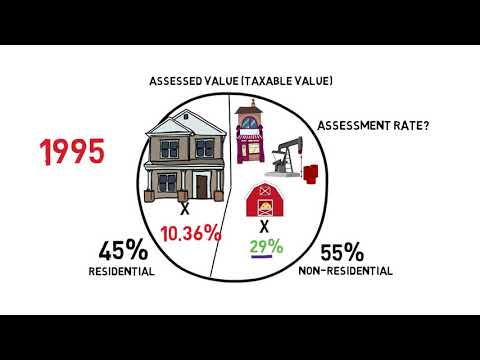

The 36-year-old Gallagher Amendment requires that the state’s harvest of property taxes is 45 percent residential and 55 percent commercial and other non-residential. Coupled with the 1992 Taxpayers Bill of Rights, or TABOR, that means when commercial tax revenue climbs, residential property tax rates go down and any subsequent attempt to increase property taxes to former levels requires voter approval.

Back when voters approved Gallagher, residential property tax rates were more than 20 percent. Today, that rate is 7.2 percent and will drop lower next year. (The Colorado Fiscal Institute made an informative YouTube video on the impact of Gallagher on fire districts. They called it “The Gallagher Fire.”

That steep decline in property tax revenue has throttled rural special taxing districts that depend on slivers of the residential mill levy to support police, fire, water, libraries, higher education, recreation, hospitals and emergency medical services. Rural districts, unlike urban districts, don’t have large swaths of commercial property supporting their budgets.

State lawmakers have grappled with potential fixes but nothing has happened.

A state commission this spring pondered several solutions to the Gallagher versus TABOR constitutional quandary and plans to propose, among a few ideas, a full repeal of Gallagher to legislators in the upcoming session in January. That proposal comes with an accompanying plan to divide the state into eight zones where administrators can adjust residential rates across their regions.

But after years of deep cuts, many special districts aren’t sitting around and waiting.

From the Eastern Plains to the Front Range and Western Slope, districts are going to voters and asking for relief.

Some are requesting to retain additional revenues under TABOR. But most are asking for the ability to adjust mill levies under Gallagher.

Specifically, they are asking voters to allow district managers to increase the mill levy to “offset revenue losses from refunds, abatement and changes to the percentage of actual valuation used to determine assessed valuation,” read the dozens of district ballot measures across the Western Slope.

“While we are hopeful that something will happen at the state level, we also have spent the past two years encouraging and educating our members to look at a local solution,” said Ann Terry, executive director of the Special District Association of Colorado, which represents 1,823 of the state’s more than 2,500 special taxing districts. “Special districts are fearful and rightfully so, that they are going to have reduced revenues in the near future. And that’s on top of years of cuts. You get to a point where you have the cut the fat all the way down to bone and what are you left with? Next to nothing.”

Terry’s association does not track special district ballot questions. Neither does the Colorado Secretary of State’s Office.

A scan of sample ballots on the Western Slope show more than 40 special districts seeking relief from Gallagher, including six districts in Pitkin County and eight in Routt County alone.

After the election, special districts will report results of any election to the Department of Local Affairs. While hard numbers are fleeting, few can remember a ballot with more requests from desperate districts.

“Not that I can recall,” said Christian Reece, the executive director of Club 20, the venerable coalition of leaders, businesses and governments from 22 Western Colorado counties. “There are a ton of measures that ultimately speak to how Gallagher is not working and needs reform.”

The special districts are not alone in their pleas for more tax revenue. Governments across the mountains are asking for help in addressing growing pains in resort communities.

Here’s a look at some of the other questions before voters in the Colorado high country Nov. 6:

- San Miguel and Pitkin counties are asking for mill levy increases to fund mental health and substance abuse services. The Roaring Fork Transit Authority is asking Pitkin and Garfield county voters to approve its first-ever property tax assessment to raise $9.5 million a year to support the growing valley’s transportation needs.

- Telluride is asking for a sales tax increase and Gunnison County a property tax bump to support affordable housing.

- Aspen is asking voters to change election dates to March from May after a committee studied the number of toilet flushes in the city — via daily sewage outflow rates at the treatment plant — to show that the week around the May election typically is the least-populated of the year in Aspen.

- Cañon City is seeking an increase in lodging tax to support tourism.

- Buena Vista is asking for a $3 to $6 tax for every room night rented in the growing town’s lodges and vacation rental properties to fund roughly $210,000 worth of capital investment every year. Typically these lodging-tax measures pass, with locals rarely averse to taxing tourists. But Buena Vista’s measure has drawn strong opposition from tourist-dependent lodging and business communities, which argue the town is relishing record tax revenue and its trustees did not take properly vet the proposal before approving it at a single meeting. Telluride this year pondered a similar per-room tax on short-term rentals to fund affordable housing but, after several months of meetings and public input, the town’s leaders opted to ask voters for a sales tax instead.

- Chaffee County is asking voters to approve a 0.25 percent sales tax increase to help the recreation-rich county and federal land managers support farms and ranches, mitigate the risk of wildfire and protect recreational resources such as campsites and trails.

Steamboat Springs seeking more flights

Steamboat Springs hopes to revive a 0.20 percent sales tax ito keep tourist-loaded jets flying into the regional airport in Hayden.

The program began in 1986 and Steamboat Springs voters last approved the sales tax in 2011. The sales tax would contribute $1.3 million a year to what would be a $4.2 million fund to entice airlines to offer direct flights into the Yampa Valley Regional Airport, creating a winter stream of skiers who spend more than $1,200 each on their ski vacations.

Even though the tax sunset in 2016, the program has lured 15 direct flights into the remote airport for the upcoming ski season.

The Local Marketing Board supports the airline program with an accommodations tax that generates about $1.6 million. The Steamboat ski area has promised to raise its support of the airline guarantee program by 45 percent — to $1.6 million — if the measure passes.

“We are hopeful the local people see the benefit of this,” said Rod Hanna, who worked for the ski area when the program was created in the mid 1980s and now serves on the community marketing board. “Because Steamboat is more remote than other ski areas like Vail, a number of our visitors are appreciative of the fact that they can fly direct. That benefits our locals too, particularly our location-neutral businesses. they can get in-and-out of Steamboat for their business too.”

Grand Junction wants more air travel, too

Tourism promoters in Grand Junction, with its blossoming recreation industry and explosive popularity, are asking for a 3 percent increase in the city’s lodging tax to support the region’s first airline guarantee program.

Similar programs have been deployed in Vail, Crested Butte, Telluride and Steamboat for several decades, with resort businesses paying extra taxes to keep planes full of tourists flying into local airports in Gypsum, Gunnison, Montrose and Hayden.

(Those taxes promise airlines that seats will be reimbursed and then resort marketing campaigns battle to put skiers in those seats. Most seasons those campaigns are successful and planes are full so resort businesses pay only a fraction of the guaranteed revenue.)

It’s typically been a ski-town tool, with resorts shepherding the programs with significant contributions. Grand Junction has a nearby ski area, Powderhorn, but the airline tax proposal goes way beyond luring skiers.

“We want to play in this game,” said Robin Brown, executive director of the Grand Junction Economic Partnership. “It will be interesting to see how the community uses this money to establish more direct flights. I think there’s a lot more interest in seeing this supporting business flights more than tourism flights.”

The top destinations for people leaving Grand Junction Regional Airport are Chicago, New York and Washington, D.C., which can serve both business and tourism needs in the Grand Valley.

The community hasn’t decided which direct flights to pursue, but the hope, Brown said, “is to pick something that can cross the two, and support businesses trying to reach other places and bring in visitors.”

☀ OUR RECOMMENDATIONS

- Colorado gray wolf died from capture-related complications, necropsy shows

- Former Colorado state senator sentenced to probation for fabricating letters amid ethics investigation

- Xcel posts nearly $1 billion operating profit from Colorado as the utility seeks rate increases for gas, electric customers

- Map: See where student enrollment is rising and falling across Colorado

- Award-winning Vietnamese restaurant in Denver finds its James Beard future on ice