A record number of Colorado special taxing districts — largely those in charge of fire protection — asked voters for tax relief on Tuesday. And overwhelmingly, voters approved requests to escape the constitutional stranglehold that has choked special district-budgets in recent years.

More than 120 special districts — including several metropolitan, a few library and a couple of ambulance, hospital, housing, cemetery, water and recreation districts — asked voters for relief under Colorado’s Gallagher Amendment.

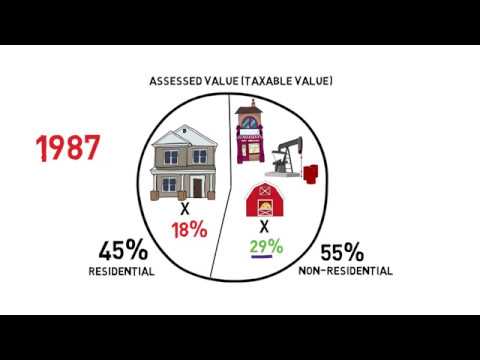

That law requires the state to maintain a specific balance between homes and commercial properties when collecting taxes. When property values rise, their assessments drop to keep within the constitutional ratio and the districts that harvest a sliver of those property assessments see their budgets crumble.

It’s a complicated math problem, for sure. But voters did not seem fazed.

Of the more than 120 special districts seeking help, voters delivered relief to more than 100. Across Colorado, voters denied only eight fire districts their requests.

“People really understand the impact of revenue reductions on fire and police just about as well as they understand everything in their communities,” said Sam Mamet, who heads up the Colorado Municipal League. “This is going to be a big, big issue for the legislature next session, and the reaction to this could go either way.”

Lawmakers can see this huge turnout for special taxing districts and think the local problems with Gallagher are getting fixed locally so there isn’t a critical need for a statewide fix, Mamet said. Or they could look at the election and, noting the tsunami of support and concern at the local level, say it’s time to come up with a statewide solution.

Mamet said it will be a huge issue for Gov.-elect Jared Polis. “I think this is one of the most important issues going on in Colorado right now. The broader implications behind this, they reach every resident in this state.”

Colorado’s residents — all of whom live inside special taxing districts and in most cases several overlapping districts — recognized the importance of their fire districts in this election. That didn’t come easy.

Telluride fire chief John Bennett spent the better part of a year speaking with residents about the looming budget crisis facing the local fire protection district. There were open houses with real estate brokers, gatherings, coffee shop confabs, panels and more.

MORE: Read more politics and government coverage from The Colorado Sun.

“It was a grassroots education and very hands-on education, not what you see in your mailers or website barrages,” Bennett said.

The campaign worked. About 70 percent of voters cast ballots in favor of the Telluride Fire Protection District’s request to adjust its mill-levy.

“We spent a lot of time on our local radio and in the newspaper and meeting with special-interest groups,” Bennett said. “I feel like our message was heard loud and clear. Let’s hope the legislature is listening to all this as well.”

Rob Goodwin, the chief of the five-station Carbondale & Rural Fire Protection District, asked voters in previous elections for the ability to override mill-levy declines and maintain existing levies. But those were two-year, temporary fixes for the firefighters who protect more than 300 square miles.

The Carbondale district never recovered from the Great Recession, when its property-tax-supported budget fell 42 percent between 2008 and 2010. When property values recovered, the district’s budget was unable to follow the trajectory, shackled by the Taxpayer’s Bill of Rights, or TABOR, which requires voter approval for all tax increases.

Belts tightened to the last notch

Goodwin, like his colleague Bennett, started sharing his budget numbers with all his neighbors. He crafted a master plan to guide equipment upgrades and service plans. A citizen committee formed to help educate residents on the district’s budget woes.

“We tightened our belts and tightened our belts. This has been going on for 10 years,” Goodwin said. “We were very clear. If we didn’t do something like this, there would be reduced services and reduced staffing. When you start losing staff, that’s really when things can change our ability to protect our community.”

It’s hard to track special taxing districts. There are more than 2,500 blanketing the state, most of them overlapping. The Special District Association of Colorado represents about 1,800 of them. The association’s staff was extra busy last week, poring over all 64 county ballots.

Ann Terry, the association’s director, was still trying to wrap her head around not just the prodigious number of questions from special districts on the ballots, but the overwhelming support from voters.

“Quite a night,” she said Wednesday. “Probably precedent setting.”

After Tuesday, she expects more special districts will line up ballot questions asking voters to provide financial stability by cutting them loose from the reins of Gallagher.

“It would not surprise me if this election cycle opens up the opportunities for other districts to ask their voters the same or similar questions,” she said.

Can the statehouse deliver a fix?

In the meantime, Terry expects legislators will labor to deliver a statewide fix. They already are. A committee met this summer to scheme solutions to the Gallagher quandary and came up with possible legislation — including a full repeal of Gallagher — for the session that begins on Jan. 4.

State Rep. Daneya Esgar, D-Pueblo, chaired the Alternatives to the Gallagher Amendment Interim Study Committee. She expects lawmakers will prioritize a fix to Gallagher.

It’s not surprising that residents responded to budget threats facing the firefighters and emergency medical techs who show up when they dial 911. But what about the library and water and recreation districts that might be less critical but no less important to the fabric of a community, Esgar wondered.

“The fact that 120 special districts had to go ask their constituents for help should be enough to show the rest of the state’s legislators that something is not working in the system,” Esgar said. “Yes, it’s great that so many districts were able to afford ballot initiatives. What about the hundreds of others who couldn’t? I think this shows that things are not functioning as they were intended.”

Still, special districts are not going to sit around and hope for a state fix, Terry said.

“As an association, we will continue to encourage our members to take a local approach to the problem,” she said. “Just in case it takes a while and they (the lawmakers) don’t get it hammered out in the waiting time.”

West Routt Fire Protection District doubled down on the ballot. The rural district based in Hayden asked voters to both bump its mill-levy collection and give it the ability to adjust that mill levy rate as property valuations fluctuate under Gallagher.

Voters gave them the modest mill-levy increase, pushing it a couple mills to 6.5 mills, but denied the district’s request for what everyone is calling “Gallagher stabilization.”

The district — with four full-time employees and a 50-year-old fire truck, has the lowest mill-levy assessment among fire districts in Routt County but has the second-highest call volume, district board president Ross Fralick said.

All the fire districts in Routt County sought relief from Gallagher, but only West Routt and Yampa fire districts doubled down with the mill levy increase request. Both districts saw voters approve the mill levy, but deny the Gallagher relief.

Voters allowed Oak Creek and Steamboat Springs fire protection districts to get out from under Gallagher’s control of property value assessments.

“Thank God we put a permanent mill levy as the first question and Gallagher as the second,” Fralick said. “I’m convinced that voters don’t really educate themselves on these types of things and they just approved us one and not the other, even though the Gallagher question was not a tax, only a way to keep our revenue balanced. We are going to be OK. This will keep us from going backwards. But we already decided that as soon as we can we are going to go for the Gallagher exemption again. I just can’t ask my guys to risk their lives in a 50-year-old fire truck anymore.”

- Syphilis cases in Colorado are exploding. The state just issued a public health order to try to stop that.

- Drew Litton: White-knuckle time for Colorado sports fans

- “What’d I Miss?”: Speaking the (human) language of sports

- Meow Wolf lays off 50 Denver employees during companywide reorganization

- Denver-based Ibotta opens public trading at $107 per share

- Preemptive power outage caused chaos in Boulder County during wind storm, Xcel customers testify

- From Denver to the New York Stock Exchange

- The dam-building beaver now plays critical role in fighting wildfires

- Colorado’s 14ers lost a couple feet after federal scientists remeasured them

- Snow pillows and laser planes offer better data for Colorado water providers facing uncertainty